Making PhonePe Business Payment Links Faster and More Merchant-Friendly

Why the Mandatory Phone Number Field Should Be Optional

Product Overview

PhonePe Business is one of India's leading digital payment platforms for merchants, enabling businesses of all sizes to accept payments seamlessly. The platform offers various solutions including UPI payments, QR codes, and custom payment links.

The Payment Link feature allows merchants to create personalized payment requests that can be shared via WhatsApp, SMS, email, or any messaging platform. This is particularly useful for collecting payments remotely, managing invoices, or accepting payments for services and products.

However, the current payment link creation flow requires merchants to mandatorily enter the customer's phone number. This seemingly small requirement creates significant friction, especially for B2B businesses, freelancers, and service providers who often don't have access to their clients' phone numbers or deal with corporate finance teams where phone numbers become obsolete as employees change roles.

The Problem

The mandatory phone number field in PhonePe's payment link creation form is causing unnecessary friction and potential abandonment for merchants. Many businesses, especially in B2B scenarios, don't have access to their customers' phone numbers. They primarily communicate via email or through company accounts payable departments. This mandatory requirement forces merchants to either:

- Spend time hunting for phone numbers they don't need

- Enter fake or dummy numbers (like 9999999999 or 0000000000)

- Abandon the payment link creation entirely and use alternative payment methods

- Switch to competitor platforms like Razorpay that don't have this requirement

Why This Matters

- Merchant Experience: Unnecessary friction in the link creation process frustrates merchants and makes them question the platform's usability

- Time Wastage: Searching for phone numbers or dealing with validation errors adds significant time to what should be a quick 30-second process

- Data Quality: When forced to enter phone numbers, merchants resort to fake entries, making the collected data worthless for notifications or analytics

- B2B Reality: In corporate transactions, payments are processed by finance departments. The phone number of an accounts payable officer today may be invalid tomorrow if they change jobs

- Competitive Gap: Razorpay and other competitors have optional phone fields, making their link creation process notably faster and more flexible

- Business Impact: Merchants who abandon link creation may stop using PhonePe Business altogether or reduce their usage frequency

- Link Generation Speed: The friction adds unnecessary seconds or minutes to the creation process, reducing the "Speed to Link" metric.

- Abandoned Transactions: High drop-off rates at the form-fill stage directly correlate to the mandatory field validation error.

- Customer Experience: If a merchant enters a fake number (e.g., the driver's number instead of the payer), the wrong person gets payment SMS spam, creating confusion.

- Merchant Retention: Friction in daily tools causes merchants to explore competitors like Razorpay who offer smoother flows.

- Platform Trust: Asking for unnecessary personal data (client phone numbers) can feel intrusive and raises privacy concerns for the merchant.

Current vs. Ideal State

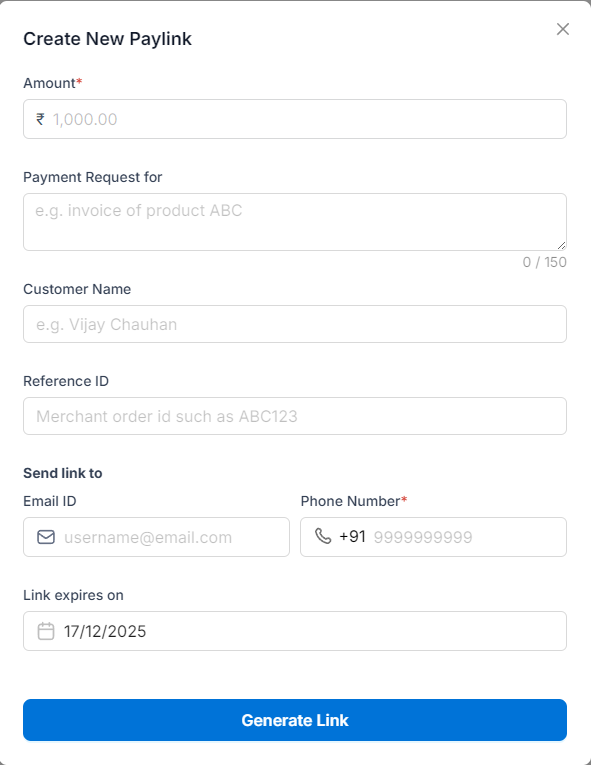

Current State: Merchant must fill Amount, Payment Request Description, Customer Name, Reference ID, Email, Phone Number (mandatory), and Link Expiry before generating the link.

Ideal State: Phone number should be optional with a clear tooltip explaining its benefit: "Add phone number to enable SMS notifications for your customer."

Root Cause Analysis

The mandatory phone number field likely stems from these assumptions:

- SMS notifications are the primary way customers receive payment links (but in reality, 70-80% of links are shared via WhatsApp or email)

- Having complete customer data is valuable for merchant CRM (but fake data defeats this purpose)

- Phone numbers help with identity verification (but payment links already have transaction tracking and UPI authentication)

- The original design focused on B2C retail scenarios where phone numbers are readily available, not B2B enterprise use cases

Identifying and Prioritizing Persona

We are focusing on the Remote Merchant and the B2B Wholesaler, as these users rely on Payment Links (unlike retail shop owners who use QR codes).

| Persona | Rohan (The Wholesaler) | Anjali (The Freelancer) | Meera (Home Boutique) |

|---|---|---|---|

| Role | Auto Parts Distributor (B2B) | Graphic Designer (Service) | Instagram Seller (Remote B2C) |

| Use Case | Sends many invoices/month to retailers. Needs to collect payments from shop owners remotely. | Bills corporate clients for project work. Sends links via email to Finance Dept. | Takes orders via DM. Customer is in another city and wants to pay via UPI. |

| Key Pain Point | Deals with many different shops. He knows the Shop Name, but rarely knows which specific employee will pay. | Does not have a mobile number for the "Finance Manager" at the client company. Only has an email address. | Sometimes customers are hesitant to share their number immediately but are happy to pay via a link. |

| Priority | P0 - Critical: High frequency, high volume. The current flow slows his operations. | P0 - Critical: The mandatory field is a complete blocker for her corporate billing. | P1 - High friction. She often has to ask twice for the number, delaying the sale. |

User Journey: The B2B Friction Point

Let's look at Anjali's journey (The Freelancer) to understand where the process breaks.

The "Send Link" Roadblock

1. Anjali completes a project for "TechCorp" and creates an invoice for INR 25,000.

2. She opens PhonePe Business to generate a payment link to attach to her email.

3. She enters the amount and "Project Fee" in the description.

4. The app demands a "Customer Mobile Number." Anjali only communicates with

`accounts@techcorp.com`.

(She does not know the phone number of the person

processing the payment.)

Fig 1: Current PhonePe Business UI. The red asterisk (*) representing compulsion on Phone Number blocks progress.

• Anjali is stuck. She cannot generate the link.

• She either enters her own number (violating terms) or a fake number.

• If she enters a fake number, the receipt data is wrong.

• She might abandon PhonePe and use a standard bank transfer, which is harder to track.

Pain Points Summary

| Pain Point | Impact on Merchant | Frequency | Current Workaround | Why It Matters |

|---|---|---|---|---|

| Mandatory phone for all links | Creates immediate friction, disrupts workflow | Every single transaction | Enter fake numbers, abandon, or waste time searching | Primary cause of frustration and potential abandonment |

| B2B merchants lack customer phone data | Cannot provide accurate information even if willing | Estimated 60-70% of B2B transactions | Use company main numbers or generic contacts | Makes the field requirement unrealistic for major user segment |

| Fake data entry | Feels dishonest, creates useless database entries | Very high (educated guess: 50-60%) | 9999999999 or any random 10-digit numbers | Defeats purpose of data collection entirely |

| Employee turnover makes numbers obsolete | Even valid numbers today become invalid tomorrow | Ongoing issue in B2B relationships | No practical workaround, keeps outdated numbers | Questions long-term value of collecting this data |

| Time consumption | 3-5 minutes per link vs. ideal 1-1.5 minutes | Every transaction where phone isn't available | Just enter fake number to save time | Significant productivity loss across thousands of merchants |

| Competitive disadvantage | Razorpay offers faster, simpler flow | Continuous comparison by merchants | Consider switching platforms | Direct threat to merchant retention and acquisition |

User Expectations

Speed: "I want to create a link in under 30-60 seconds. Amount > Description > Share."

B2B Friendly: "My client is a company, not a person. Let me track by Invoice Number or Company Name."

Flexibility: "If I have the number, I'll add it for SMS. If I don't, let me generate the link and share it via Email myself."

Prioritization Framework (RICE)

| Problem/Feature | Reach | Impact | Confidence | Effort | RICE Score |

|---|---|---|---|---|---|

| Make Phone Number Optional | 9/10 | 9/10 | 8/10 | 2/10 | 324 |

| Add contextual help tooltip | 9/10 | 5/10 | 9/10 | 1/10 | 405 |

RICE Scoring Explanation

Make Phone Number Optional (RICE Score: 324)

- Reach (9/10): Affects almost all merchants creating payment links, especially B2B segment (estimated 60-70% of transactions). Even B2C merchants would benefit from flexibility.

- Impact (9/10): Directly removes primary friction point. Expected to significantly reduce abandonment, improve merchant satisfaction, enhance data quality by eliminating fake entries, and position PhonePe competitively against Razorpay.

- Confidence (8/10): High confidence based on competitor analysis (Razorpay success), merchant feedback patterns, and logical assessment that optional fields reduce friction. Slightly less than 10 due to lack of direct A/B test data.

- Effort (2/10): Low engineering effort. Requires removing frontend validation, updating backend to accept null values, modifying notification service to handle missing phone numbers. Estimated 1-2 week implementation.

Add Contextual Help Tooltip (RICE Score: 405)

- Reach (9/10): Every merchant sees the form, so tooltip visibility is universal.

- Impact (5/10): Helpful for clarity but doesn't solve core friction. Explains why phone is useful but doesn't remove the barrier for merchants who don't have numbers.

- Confidence (9/10): Very confident that contextual help improves UX. Standard best practice in form design.

- Effort (1/10): Minimal effort. Just adding a tooltip or help text element. Can be implemented in hours.

Recommendation: "Make Phone Number Optional" is the clear winner with highest impact-to-effort ratio. It should be prioritized as P0 and implemented immediately. The contextual tooltip can be bundled with it as a quick add-on. Other features like bulk upload and WhatsApp integration can follow in subsequent releases once the core friction is resolved.

Proposed Solution

Primary Solution: Make Phone Number Optional

Change the phone number field from mandatory to optional with clear contextual guidance.

Implementation Details:

- Remove the red asterisk (*) from the Phone Number field

- Add a subtle help tooltip icon next to the field with text: "Adding a phone number enables SMS notifications to your customer. You can skip this if you'll share the link via email or WhatsApp."

- Update backend validation to accept empty/null phone values

- Modify notification service to send email-only notifications when phone is not provided

- Keep the field visible and accessible for merchants who do have phone numbers

Why This Works:

- Removes Primary Friction: Merchants can now create links in under 2 minutes without hunting for unavailable data

- Maintains Flexibility: Those who have phone numbers can still enter them and benefit from SMS notifications

- Improves Data Quality: Only merchants who actually have valid numbers will enter them, eliminating fake data

- Quick to Implement: Low engineering effort, can be deployed in 1-2 weeks

- Competitive Parity: Matches Razorpay's approach, removing their advantage in this area

- Better User Experience: Respects merchant's reality and doesn't force unnecessary steps

Success Metrics (KPIs)

| Metric | Goal | Why it matters |

|---|---|---|

| Link Creation Completion Rate | Significant Increase | Primary indicator that friction is removed. |

| Drop-off Rate | Substantial Reduction | Directly correlates to removing the blocker. |

| Data Validity (Phone Numbers) | Significant Improvement in real entries | If the field is optional, users will only enter it when they have a real number. |

Business Impact Metrics

| Metric | Expected Outcome |

|---|---|

| Gross Merchandise Value (GMV) | Increase in B2B TPV as merchants stop abandoning the flow and switching to bank transfers. |

| Merchant Time Savings | Reduction in the time required to create a payment link, improving merchant efficiency. |

| Support Ticket Volume | Reduction in tickets related to "Payment Link creation errors." |

Risks & Mitigation

| Risk | Likelihood | Mitigation Strategy |

|---|---|---|

| Merchants might forget to add any identifier | Medium | If both Phone and Invoice ID are empty, show a gentle prompt: "Adding a Reference ID helps you track this payment later." |

| Reduced SMS Visibility | Low | Most B2B links are shared via Email/WhatsApp. The system SMS is rarely the primary notification channel for these users. |

| Fraud/Dispute Resolution | Low | Leverage transaction history and email verification. Phone number is not a primary fraud signal for link generation. |

Conclusion

PhonePe Business is evolving from a retail QR solution to a comprehensive business suite. However, the current Link Generation flow is stuck in a B2C mindset by forcing a mobile number for every transaction. This alienates B2B merchants, freelancers and wholesalers who transact based on Invoices, not personal phone numbers.

By making the mobile number optional, we solve key problems at once: we reduce the high drop-off rate, we clean up our data by eliminating fake numbers and we directly neutralize a key competitive advantage held by competing platforms. This is a low-effort, high-impact change that respects the merchant's actual workflow and positions PhonePe Business as a serious, modern partner for B2B commerce.

Interested in B2B Product Strategy?

I'd love to solve your problems on optimizing fintech flows for business users.

Let's Connect